Sales Down 47% - GTA Market Crashes....

Headlines: Sales Down 47% - GTA Market Crashes

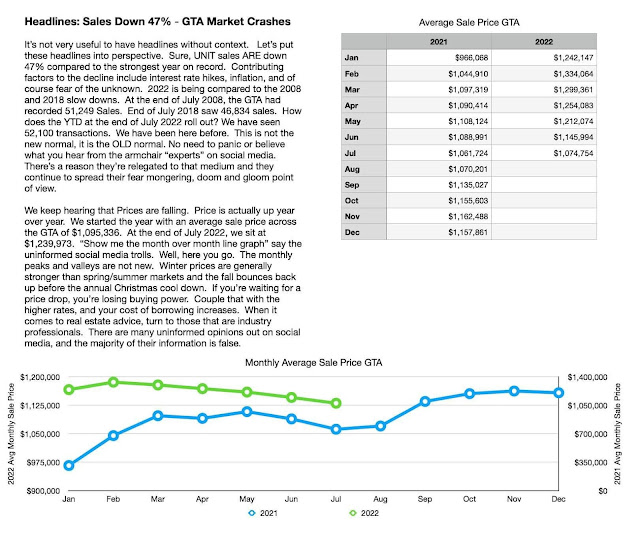

It’s not very useful to have headlines without context. Let’s put these headlines into perspective. Sure, UNIT sales ARE down 47% compared to the strongest year on record. Contributing factors to the decline include interest rate hikes, inflation, and of course fear of the unknown. 2022 is being compared to the 2008 and 2018 slow downs. At the end of July 2008, the GTA had recorded 51,249 Sales. End of July 2018 saw 46,834 sales. How does the YTD at the end of July 2022 roll out? We have seen 52,100 transactions. We have been here before. This is not the new normal, it is the OLD normal. No need to panic or believe what you hear from the armchair “experts” on social media. There’s a reason they’re relegated to that medium and they continue to spread their fear mongering, doom and gloom point of view.

We keep hearing that Prices are falling. Price is actually up year over year. We started the year with an average sale price across the GTA of $1,095,336. At the end of July 2022, we sit at $1,239,973. “Show me the month over month line graph” say the uninformed social media trolls. Well, here you go. The monthly peaks and valleys are not new. Winter prices are generally stronger than spring/summer markets and the fall bounces back up before the annual Christmas cool down. If you’re waiting for a price drop, you’re losing buying power. Couple that with the higher rates, and your cost of borrowing increases. When it comes to real estate advice, turn to those that are industry professionals. There are many uninformed opinions out on social media, and the majority of their information is false.

Comments

Post a Comment